|

|

|

#11 |

|

Senior Member

Join Date: Oct 2007

Location: Orange County, CA

Posts: 9,483

|

Nice post.

As usual, you take up a lot of space yet manage to say almost nothing.

__________________

Fitter. Happier. More Productive. "Everyone is against me. Everyone is fawning for 3D's attention and defending him." -- SeattleUte |

|

|

|

|

|

#12 | |

|

Senior Member

Join Date: Jan 2006

Location: NOVA

Posts: 3,005

|

Quote:

__________________

太初有道 |

|

|

|

|

|

|

#13 | |

|

Senior Member

Join Date: Aug 2005

Location: the far corner of my mind

Posts: 8,711

|

Quote:

What does "loopholes closed" mean, exactly? One man's loophole is another man's lifeline. I would like to know what is considered aloophole.

__________________

Sorry for th e tpyos. |

|

|

|

|

|

|

#14 | |

|

Senior Member

Join Date: Jan 2006

Location: NOVA

Posts: 3,005

|

Quote:

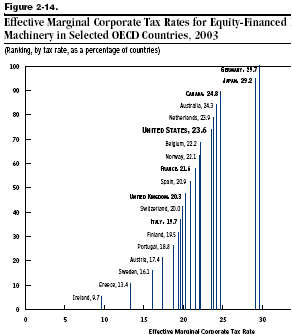

The US's corporate tax rate is 35%, highest among industrialized countries. But the effective rate is much much lower because of deductions. Lowering the rate and closing distortions will allow businesses to quit wasting time looking for loopholes and focus on productive activities.

__________________

太初有道 Last edited by ChinoCoug; 10-29-2008 at 05:42 PM. |

|

|

|

|

|

|

#15 |

|

Senior Member

Join Date: Dec 2006

Posts: 8,596

|

__________________

"Have we been commanded not to call a prophet an insular racist? Link?" "And yes, [2010] is a very good year to be a Democrat. Perhaps the best year in decades ..." - Cali Coug "Oh dear, granny, what a long tail our puss has got." - Brigham Young |

|

|

|

|

| Bookmarks |

|

|